the profit center is now purpose capital

Fixed vs Variable Costs in Your Business

< back to blog home

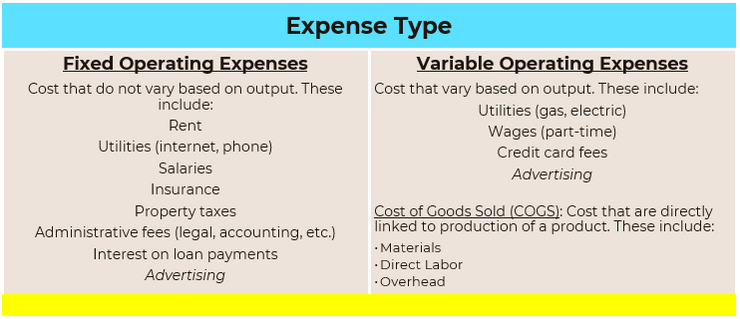

Monitoring your expenses is an essential element of financial oversight for any business owner. Knowing what money is going out the business and what costs you incur to operate is just as important as identifying how your business will generate revenue and bring money into the business. Businesses incur both fixed and variable expenses and understanding your cost structure will help you manage profitability and cash flow. Elements of your cost structure will also help you calculate key metrics for your business such as gross profit, breakeven point and net profit margin.

Fixed vs Variable Expenses

1. Fixed expenses

Fixed expenses are costs that do not vary based on output. These expenses are sometimes referred to as your overhead. These are especially important to monitor and track because these are costs that you will have whether you make sales or not. Because of this, these cost will help you identify your breakeven point, or the minimum amount of sales you need to cover your fixed expenses. Examples of fixed expenses include:

Rent and lease payments

Utilities (internet, phone)

Salaries & Benefits

Insurance

Property taxes

Administrative fees (legal, accounting, etc.)

Interest on loan payments

2. Variable expenses

Variable expenses are costs that vary based on output. With variable expenses, the more you produce, the higher these expenses will be. Examples of fixed expenses include:

Utilities (gas, electric)

Wages (part-time/hourly)

Credit card fees

Commissions on sales

Advertising

Logistics/Shipping

Cost of Goods Sold (COGS) is a type of variable expense and are the costs that are directly linked to production of a product. COGS include materials and direct labor (labor associated with production/manufacturing). Certain overhead expenses associated with manufacturing may also be included in COGS.

next post

previous post

215-326-9365

hello@purposecapitalgroup.com

Purpose Capital is a strategic finance consulting firm that supports leaders of high-impact organizations effectively manage their financial resources.